How to Become a Micro Lender in South Africa – A Step-by-Step Guide

Starting your own business as a micro lender in South Africa can be a rewarding venture.

However, it's important to know that this industry is strictly regulated under the

National Credit Act (NCA), No. 34 of 2005.

If you're planning to offer credit, even once—you, must register with the National Credit Regulator (NCR).

Let’s break it down in simple steps:

Step 1: What is a Credit Provider?

A credit provider is any individual or a business who gives credit to others under a formal agreement. This includes:

- Personal or payday loans

- Credit cards

- Store or retail credit

- Lease or mortage agreements

- Secured or pawn loans

If you offer any of the above to more than one person, even just once, you must register with the NCR.

You'll need to register if you:

- Sell goods on services or credit

- Offer credit or loans (including pawn deals)

- Provide store credit or credit facilities

- Act as a lender under any credit agreement

Step 2: Registering as a Credit Provider

To become a credit provider, you must:

- Be a South African citizen or have a registered SA business

- Have no criminal history (especially related to fraud or dishonesty)

- Be financially capable of running a credit business

- Understand and comply with the National Credit Act

- Be registered with CIPC if operating as a company

Required Documents for NCR Application

Here's what you'll need to submit with your application

- Application Form (Form 2)

- CIPC registration documents (or equivalent if not a company)

- Share certificates (if a company)

- Certified ID copies of all directors, members, or owners

- Disqualification declaration (Part 7 of NCR Application Form)

- Police clearanc certificates (less than 6 months old)

- Bank confirmation letter, cancelled cheque, or bank statement

- SARS Registration Proof

-

Payment of required Fees, including:

- R550 non-refundable admin fee

- R250 per business location/branch

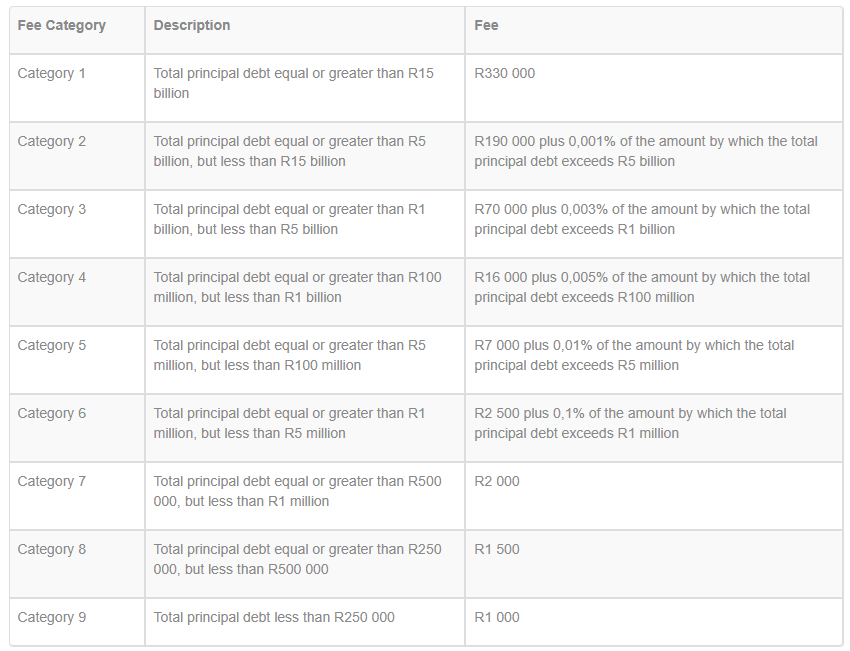

- Initial registration fee based on your business type. The registration fee is indicated in the table below for each sub category:

Want to Offer Developmental Credit?

If you're aiming to support underserved communities by offering developmental credit, you must also:

- Be a registered credit provider.

- Be a company, trust, co-operative or bank.

- Have the right systems or staff in place - or a solid plan

- Submit a motivational letter explaining your developmental goals

This allows for flexibility in the credit rules - but only if the NCR approves your capacity to manage it responsibly.

Ongoing Compliance - What Happens After Resistration?

After you are regitered, you'll need to:

- Submit annual reports to the NCR

- Follow Lending Laws (interest caps, affordability checks, etc.)

- Keep accurate records of all credit transactions

- Avoid reckless lending - only lend to those who can afford to repay

Need Help?

If you have any questions or need help with the registration process, reach out to the NCR’s Registrations Department: Phone: 011 554 2700 Email: [email protected]

Ready to Start?

Becoming a micro lender in South Africa can be a great business opportunity, but it comes with many legal responsibilities. If you follow the steps above and make use of ACPAS’ Loan Management Software and bespoke websites, you’ll be on the right track to running a compliant and successful credit business.

Contact ACPAS for details

Contact Us today for more information about our automated Loan Management System (LMS) where we can help you manage your customers and stay compliant!